Congress has quickly engaged in putting together potential aid packages for farmers that would more than double the Trump administration's $12 billion under the Farmer Bridge Assistance (FBA) Program.

Federal Reserve: Observations on the Ag Economy- April 2022; Input Costs in Focus

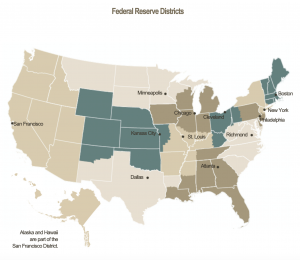

On Wednesday, the Federal Reserve Board released its April 2022 Beige Book update, a summary of commentary on current economic conditions by Federal Reserve District. The report included several observations pertaining to the U.S. agricultural economy.

* Sixth District- Atlanta– “Agricultural conditions remained mixed. Parts of the District experienced moderately dry conditions. On a month-over-month basis, Florida’s orange crop and grapefruit productions were down 5 percent in February and both forecasts were below last year’s production.

Agriculture contacts noted fertilizer and chemical costs have doubled recently and are expected to remain elevated over the next six months.

“The conflict in Ukraine is expected to have a ‘profound effect‘ on commodity prices going forward, especially for potash, a critical component of fertilizer.”

* Seventh District- Chicago– “Agriculture markets experienced price increases and substantial volatility during the reporting period related to Russia’s invasion of Ukraine. Prices for corn, soybeans, and wheat moved higher, as did input prices, particularly for fertilizer and diesel fuel.

In the week ended April 18, average U.S. gas prices per gallon decline, and average U.S. diesel prices per gallon increase, to $4.07 and $5.10, respectively https://t.co/DjeWwCdqqB pic.twitter.com/P0sTBQXF3G

— St. Louis Fed (@stlouisfed) April 19, 2022

“Some farmers switched to using manure as fertilizer, though availability was limited, particularly in areas without substantial livestock activity. Rising input costs led to a shift in planting plans from corn to soybeans, which require less expensive inputs. In addition, concerns deepened about whether input deliveries would be in time for planting.

#Iowa Production Cost Summary, https://t.co/bbux77rQXz pic.twitter.com/Esum4OFb5t

— Farm Policy (@FarmPolicy) April 20, 2022

“On average, prices for cattle, hogs, eggs, and milk were all up from the prior reporting period. Strong gains in farmland prices continued, in part because of greater interest by investors.”

* Eighth District- St. Louis– “Agriculture conditions have improved slightly since our previous report. The number of acres planted across the District for corn, cotton, rice, and soybeans was little changed from last year. Tennessee saw the most growth of all District states, with a moderate increase of 10% in acres planted. Corn and rice were planted in lesser quantities compared with last year, while cotton and soybeans increased in acreage. Contacts have expressed concern about a continued rise in input costs and availability of inputs, particularly fertilizer.”

* Ninth District- Minneapolis– “District agricultural conditions improved moderately heading into planting season. Strong crop prices appeared to outweigh increases in input costs, bolstering incomes, according to contacts; however, livestock and dairy producers were seeing their margins squeezed. Early reports indicated a reduction in District corn acres planted and an increase in wheat and soybean acres in 2022.”

* Tenth District- Kansas City– “The Tenth District farm economy remained strong along side elevated commodity prices, but volatility and uncertainty in global markets emerged as a risk for the sector. The price of wheat and corn increased rapidly, and soybean prices increased modestly in March as the conflict in Ukraine led to expectations of substantial disruptions in global production and trade activity. The turmoil also led to rapid increases in the price of major inputs such as fuel and agricultural fertilizers.

Farming is an expensive profession. pic.twitter.com/HPPYsbZuVK

— Nathan Kauffman (@N_Kauffman) April 20, 2022

“While crop prices supported farm revenues, concerns about the cost and availability of agricultural inputs intensified, and higher feed prices could also pressure profit margins for livestock producers. In addition, surging grain prices increased costs for food processing facilities in the District.”

* Eleventh District- Dallas– “Drought continued to worsen across much of the district, hampering agricultural conditions.

Higher input costs— including fuel, fertilizer, and machinery—are pinching the financial position of many agricultural producers.

“While higher crop prices can help alleviate some of the financial pressure, it remains to be seen if prices will still be high at harvest time when producers have a crop to sell, and drought risk is deterring many from forward contracting at current prices. On the livestock side, cattle prices have been flat to down over the past six weeks and feed costs have risen sharply, and as a result some herd culling has begun.”

* Twelfth District- San Francisco– “Conditions in the agriculture and resource sectors strengthened a bit. Strong demand for regional agricultural products contributed to elevated food prices that are expected to continue to rise.

At the same time, input cost increases also accelerated with one contact projecting most farmers to break even as the best scenario this year.

“Greater costs were attributed to higher expenses for fertilizer, labor, and fuel. A stronger dollar contributed to a decline in agricultural exports over the first quarter of 2022. Additionally, multiple contacts reported periodic disruptions in agricultural exports due to lack of shipping containers and port congestion. Transportation costs were reported to increase two-fold over the last year. While these disruptions are expected to subside, many believed that prices will remain elevated relative to the pre-pandemic level.”