Congress has quickly engaged in putting together potential aid packages for farmers that would more than double the Trump administration's $12 billion under the Farmer Bridge Assistance (FBA) Program.

Iowa Farmland Values, and the Corn Belt Economy- “At a Crossroads”

The 2017 Iowa State University Land Value Survey was released on Tuesday, and showed that farmland values climbed 2% this year. The survey was conducted in November by the Center for Agricultural and Rural Development at Iowa State University and Iowa State University Extension and Outreach. Highlights of the survey are discussed in today’s update, along with recent news articles that explored the state of the Corn Belt agricultural economy in greater detail.

2017 Iowa State University Land Value Survey

Donnelle Eller reported on Tuesday at The Des Moines Register Online that, “Iowa farmland values climbed 2 percent to $7,326 an acre this year, the first increase after three years of decline, an Iowa State University survey Tuesday showed.

“The improved results fail to signal a change in the land market, though, said Wendong Zhang, an ISU economics professor.

“Limited land supply is driving this year’s increase in farmland values, not an improvement in the overall farm economy, said Zhang, who leads ISU’s annual survey.”

‘Commodity prices and farm income are still stagnant,’ [Dr. Zhang] said. ‘Given the rising interest rates and stagnant farm income, I would not be surprised to see a continued decline in values in the future.'”

The Register article added that, “[Dr. Zhang] said he doubts land values might return to their ‘golden years.’

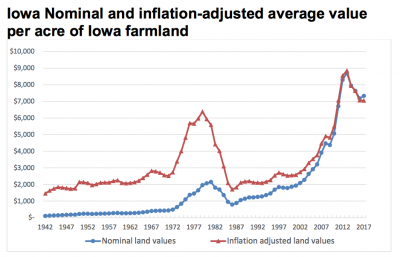

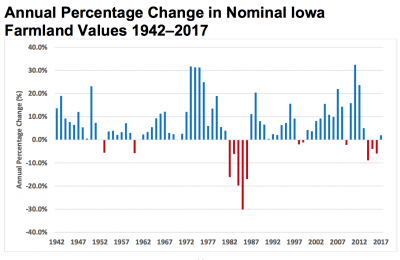

“Beginning in 2004, the ethanol boom, historically low interest rates and other factors pushed five consecutive years of double-digit growth in average farmland values that hit a historic peak of $8,716 an acre in 2013.

“However, declining corn, soybean and other commodity prices have pushed values down.”

#Iowa: @ISUExtension #ISULandValue - Land Values by County, 2017 pic.twitter.com/8aXvsoBuFq

— Farm Policy (@FarmPolicy) December 12, 2017

Ag Economy: Large Production, Low Prices, Financial Stress

Meanwhile, a pair of articles in Sunday’s Omaha World-Herald explored the state of the Corn Belt economy in more detail.

Barbara Soderlin reported that, “The situation facing corn and soybean growers has southeast Nebraska farmer Steve Sugden looking for an off-farm job to help support his family. That includes his wife, a schoolteacher; his daughter, a University of Nebraska junior; and twin sons, freshmen in high school.

“The low prices farmers are fetching for their crops don’t cover business costs at many operations. Average monthly prices for corn have been below $3.50 a bushel for over a year now; farmers received over $7 and in some cases over $8 in 2012 and 2013.”

Ms. Soderlin pointed out that, “Farm income plunged for three straight years from 2014, and only a slight uptick is expected this year, the U.S. Department of Agriculture said in November. Crop revenue continues to fall, however. Livestock sales are growing.”

2017 cash receipt forecasts for #cattle, #dairy, #broilers, and #hogs are all higher than 2016 levels-- "U.S. cash receipts for selected animals/products, 2013-17F," @USDA_ERS pic.twitter.com/GHtprYtYwl

— Farm Policy (@FarmPolicy) December 12, 2017

The article added that, “And next year, belt-tightening is likely to continue, as economists’ forecasts call for no meaningful increases in crop prices.

“One of the reasons for stagnant low prices: There is a glut of grain on the market. And U.S. farmers this coming spring are expected to plant still more acres than they did this year of corn and soybeans. Competition also is growing globally. So there’s no reason to expect prices to rise, economists say.”

Cole Epley reported in Sunday’s Omaha World-Herald that, “Nothing short of a catastrophic event is expected to pull grain commodities prices out of the years-long slump in which they’re entrenched.

“But Nebraska bankers say a keen eye on finances should carry the state’s crop farmers through what promises to be another year of razor-thin margins.”

Mr. Epley explained that, “Assurances around U.S. foreign trade policy are lacking, and that has some bankers convinced that prices could go even lower.

‘Export sales are an important part in price stability, so being able to maintain our markets as trade agreements potentially fall away could be hard and have a bad impact on prices,’ said Daryl Wilton, executive vice president and chief credit officer at Cornerstone Bank in York.

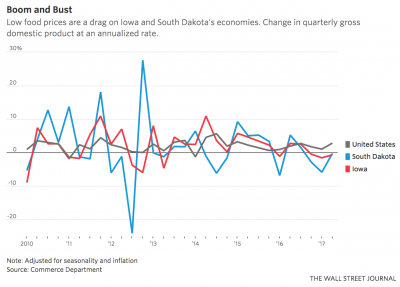

Also, Sharon Nunn and Benjamin Parkin reported earlier this month at The Wall Street Journal Online that, “Farmers are producing too much food, holding down prices and holding back economies in states with big agricultural industries.

“South Dakota and Iowa are the only two states in the country where gross domestic product fell in the second quarter. Ultra-low crop and livestock prices stemming from a global oversupply have squeezed farm incomes, pulling down Iowa’s GDP 0.7% and South Dakota’s 0.3% from the prior quarter.”

The Journal writers indicated that, “Despite low prices, farmers in the U.S. and globally keep producing, suggesting that agriculture will continue to weigh on economies across the Great Plains and other states that are disproportionately dependent on farming and ranching for growth.”

The oversupply and low prices ‘will last at least until next summer,’ said Scott Irwin, an agricultural economist at the University of Illinois. ‘That’s when we will enter the growing season for Northern Hemisphere crops.’

“Crop farmers in the Midwest and Great Plains recently harvested another bumper corn and soybean crop, while increasingly competitive producers in countries like Russia erode U.S. wheat farmers’ share of the global export market.”