A bipartisan group of former leaders of America's major agricultural commodity associations and biofuels organizations, farmer leaders, and former senior USDA officials sent congressional ag leaders a letter on Tuesday…

Senate Farm Bill Hearing, Risk Management- Crop Insurance, Payment Limits, Base Acres

On Tuesday, the Senate Agriculture Committee held a Farm Bill hearing that focused on commodity, credit, and crop insurance programs. This follows previous Farm Bill field hearings in both Kansas and Michigan, as well as Committee meetings on the farm economy, agricultural research, and conservation issues. Today’s update highlights issues that lawmakers discussed at yesterday’s hearing, including crop insurance, payment limits and eligibility for farm programs, and base acres.

Crop Insurance

In his opening statement at yesterday’s hearing, Ag Committee Chairman Pat Roberts (R., Kans.) noted that, “When producers put their seeds in the ground, they do not expect a hail storm to hit right as they are ready to harvest their crops. They would much rather reap the benefits of their hard work in the marketplace, rather than receive an indemnity.

“The last Farm bill made significant changes, and unlike previous policies, today’s commodity programs—like crop insurance—are triggered only when there is a loss.”

In her opening remarks yesterday, Committee Ranking Member Debbie Stabenow (D., Mich.) indicated that, “When it is available, crop insurance is one of, if not the most important risk management tool for our producers. But historically, it hasn’t been available to some of the farmers who need it most.

“That’s why I have fought to expand and strengthen crop insurance for all farmers, from expanding coverage to specialty crop growers, organic producers, and beginning farmers, to providing a whole-farm option for diversified farms.”

Iowa farmer, and National Corn Growers Association Board Member, Bruce Rohwer pointed out yesterday that:

As essential as commodity programs are to farmers’ risk management plans, federal crop insurance is consistently ranked by corn farmers as their most important risk management tool.

NCGA's Bruce Rohwer to @SenateAgGOP @SenateAgDems: risk management tools are critical during a weak farm economy #protectcropinsurance pic.twitter.com/c1wYlkKDwj

— NCGA Public Policy (@NCGA_DC) July 25, 2017

And David Schemm, the President of the National Association of Wheat Growers (NAWG) explained that, “Over 8 percent of wheat producers are considered by USDA’s Economic Research Service to be ‘highly leveraged‘ (a debt-to asset ratio between .4-.69) and 16 percent are considered to be ‘extremely leveraged’ (a debt-to-asset ratio over .69).”

16% of wheat producers are considered by @USDA_ERS’s to be “extremely leveraged” @SenateAgGOP hearing, @wheatworld pic.twitter.com/kUvVzKrtAd

— Farm Policy (@FarmPolicy) July 25, 2017

“The last couple of years have been particularly difficult for wheat farmers. Crop insurance has played an important role in helping producers get through the current low prices,” Mr. Schemm said.

Mr. Schemm also noted that, “In addition to supporting the current structure of the producer support component of crop insurance, NAWG opposes any cuts to the delivery system.”

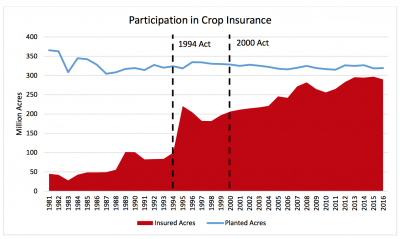

William Cole, the Chairman of the Crop Insurance Professionals Association, testified yesterday that, “Under the leadership of Chairman Roberts and others, the Agricultural Risk Protection Act was developed in a way that would give meteoric rise to both participation and coverage levels of farmers and ranchers, doubling in 17 years the participation rate achieved over the previous 56.”

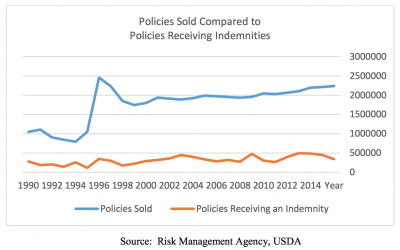

And Ron Rutledge, the President and Chief Operating Officer at Farmers Mutual Hail Insurance Company of Iowa stated yesterday that, “The average deductible for a crop insurance policy is 25%. In other words, a farmer must lose 25% of their crop or the value of their crop before they receive any benefit from crop insurance. Even if a farmer does not meet this deductible, that farmer must still pay their premium. The vast majority of farmers who purchase crop insurance policies do not receive an indemnity payment.”

Chairman Roberts queried the first panel of witnesses yesterday with this question: “All of you mentioned crop insurance. I have a particular and keen interest in that program. We’ve all heard about the hail, the droughts, the floods, other risks that you have to face. Are there particular risks—and this is for the entire panel—are there particular risks that are not currently addressed under this program? And if you could, what improvements should we consider in the crop insurance in the farm bill?”

Mr. Rohwer responded by saying:

“The largest concern is that we not fix something that is not broken.”

Mr. Schemm indicated that, “The one area that we are discovering that we believe there could be room for improvement is in regards to a quality aspect of it. And particularly when we get into our northern states, when they have a quality component called falling numbers affect them on their crop insurance side of it, where producers are actually losing value to their crop from a quality standpoint and RMA is actually utilizing that against their yield component.

“And so there’s tweaks that need to be made in that area when it comes to the quality side of it, but overall the program is functioning well, and throughout the country I hear from our producers that it is vitally important that we protect it and maintain it where it’s at.”

"We will NOT be cutting #cropinsurance. Period." Thank you @SenPatRoberts! pic.twitter.com/tSwGtF351k

— NCIS (@UScropinsurance) July 25, 2017

Payment Limits and Eligibility for Farm Programs

Iowa GOP Senator Chuck Grassley used a portion of his time at yesterday’s hearing to make the following statement:

“I’d like to address some comments that I’ve seen about payment limits and eligibility for farm programs. First, to groups that are complaining about the definition of family members related to program eligibility, I agree. That was wrong to include at the last minute of the farm bill conference. My original payment limit language was far superior and much simpler. In fact, this family member gobbledy-goop was included solely as an end around my payment limit amendment which was passed with bipartisan support on the floors of both bodies of the Congress in exactly the same form and should not have been touched by conferees. The organizations who are now complaining were part of the effort to thwart my commonsense bipartisan payment limit reforms.

“For those who do not remember my payment limit amendment from the last farm bill, it was actually really quite simple. Everyone who really farms maintains eligibility, and an operation had the potential to name one additional manager. Admittedly, a few people who do not farm, yet were listed as managers for the sole purpose of getting subsidies, would have been kicked off the farm program, but that was a very intent of my amendment, which I am sure everybody understands.”

Sen. Grassley added that, “Perhaps the most important thing that I can do is explain why this issue is so important. Giving non-farmers subsidies is completely indefensible, especially when we have a $20 trillion debt. If bigger farmers are as efficient as they claim, they should not need unlimited subsidies to make their business model work. All they’re doing is shifting risk to the taxpayers.

“The true impact of unlimited subsidies to the largest farmers is that it keeps young farmers out. Mr. Schemm stated, in his testimony, that the average age of U.S. farmers is 58. That is not surprising, considering the only ways to really get into farming is to be born or marry into a farming operation. Our rural communities have consolidated enough. When the largest farmers continue to take land, that reduces the customer base in rural towns for restaurants and stores and small businesses generally, and decreases the number of children in schools.

“So Mr. Chairman, for the life of me I do not understand how $125,000 a year, which is usually 250,000 if the farmer is married, and double those limits again if they grow peanuts, is not enough to get farmers through a year. I do not envy the budget challenges that Chairman Roberts faces with the farm bill one bit, but why do we leave loopholes in place that open us up for ridicule?

What is the harm of supporting a policy that helps young and beginning farmers, gives us credibility against our critics, and saves money for the taxpayers?

“So Mr. Chairman, I’m just trying to help you get by a very tight budget situation as we try to help those farmers that really are on the land doing the work and managing from the standpoint of participating.”

Sen. John Boozman (R., Ark.) later asked, “I hear a lot of concerns from producers about how further ratcheting down payment limitations could impact family farmers. Can you briefly describe what would happen to your family’s farm if a payment limit of $50,000 was adopted in this farm bill?

Jennifer James, a fourth generation rice farmer from Newport, Arkansas responded by saying:

If a payment limit of $50,000 were to be adopted, it would most likely put my family farm out of business, and many others like mine.

“Just to give you a little example, $50,000 in the current price situation would cover around 250 acres of rice. With the cost of the tillage equipment, the planting equipment, a combine, a grain cart, semi trucks to haul that rice to market, it would not be economically feasible to plant 250 acres of rice, so that payment limit just is not economically feasible.”

Base Acres

Sen. John Thune (R., S.D.) noted in part yesterday that, “I also, as part of the recently introduced bill, included a provision that would require mandatory base updates using the planted and considered or prevented planted acres during the years 2014 to 2017. The bill also eliminates generic base acres that were created in the 2014 Farm Bill, but leaves STAX in place.

“According to CBO, the mandatory base update saves $466 million, and the elimination of generic base acres saves $2.454 billion over ten years. That, again, according to CBO. Although I believe that calculating any future farm bill commodity title payments that use base acres in the calculation should use a mandatory base update, I don’t expect the commodity organizations to support this.

“But I do want to ask all of you the question about whether or not you think a change like that would make sense. I mean, do you believe that eliminating commodity title payments on land with base acres that has not been planted to a commodity crop in the years 2014 to 2017 would be good policy and should be pursued in the next farm bill?

Received positive feedback on my #ThuneFarmBill proposals from Kevin Scott, a SD farmer, and other panelists in @SenateAgGOP hearing today. pic.twitter.com/z3irSHCy4a

— Senator John Thune (@SenJohnThune) July 25, 2017

Alabama farmer Nick McMichen, who appeared before the Committee on behalf of the National Cotton Council, responded by saying, “In regard to generic base acres, which is very sensitive to the cotton industry, they were established in the current farm bill because cotton was no longer a covered commodity due to the Brazil WTO case. Cotton base acres would have been no value to producers and landowners unless cotton base was reallocated to allow for support on covered commodities on these planted acres.

“Generic base was never intended to be a long-term policy and it should be dealt with in the next farm bill, if not before. There are various ways to convert generic base back to cotton or cottonseed base, and possibly other covered commodity bases, and the cotton industry is evaluating these options to help develop industry regulations. We all agree, though, that the crop bases should be decoupled in the next farm bill.”

Sen. Thune added that, “I just think that base acres ought to reflect more recent planting history and that we shouldn’t be, you know, we shouldn’t have base acres that haven’t been farmed for years that still have bases and are receiving payments. And I think there’s some examples where that happens. And I think this would be a real dollar saver, it would be more efficient, and I think it would be a better farm policy. So I hope your organizations will take a look at it and give us some feedback. Thank you.”

See also, “Planted acres vs. base acres and the coming Farm Bill debate,” by John Hart (Southeast Farm Press Online, July 25, 2017).