A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

CRS Report, “USDA’s Coronavirus Food Assistance Program: Round Two (CFAP-2)”

Last month, the Congressional Research Service (CRS) released a report titled, “USDA’s Coronavirus Food Assistance Program: Round Two (CFAP-2).” Today’s update includes highlights from the report, which was authored by Randy Schnepf.

Background

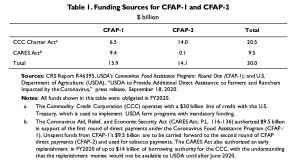

Mr. Schnepf explained that, “On September 18, 2020, the U.S. Department of Agriculture (USDA) announced a second round of Coronavirus Food Assistance Program (CFAP-2) payments valued at up to $14 billion. CFAP- 2 focuses on losses or additional marketing costs as a result of the Coronavirus Disease 2019 (COVID-19) pandemic that were incurred during the second through fourth quarters of 2020. CFAP-2 follows a first round of payments (CFAP-1) that USDA announced at $16 billion in April 2020 for losses in the first quarter of 2020 and from which USDA had paid $10.5 billion as of December 5, 2020.”

Funding

With respect to funding, Mr. Schnepf pointed out that, “The [Commodity Credit Corporation (CCC)] operates with a $30 billion line of credit with the U.S. Treasury, a portion of which was used in FY2020 to fund a variety of activities authorized under the 2018 farm bill, prior farm bills, and other enacted legislation. USDA also tapped CCC funding to provide trade mitigation assistance to agricultural producers in FY2020 through the Market Facilitation Program. Obligating CCC funds for these activities would normally have left insufficient funding available in CCC’s line of credit for CFAP-2 obligations. However, when the CARES Act was signed into law on March 27, 2020, it authorized an early replenishment in FY2020 of up to $14 billion of borrowing authority for the CCC, with the understanding that the replenishment monies would not be available to Secretary Perdue until later in the year. The $14 billion from the CARES Act was not new spending; rather, it reimbursed the CCC for past spending. After the funds were transferred, which required waiting for a June 2020 financial statement, the CCC had renewed access to more funding for future obligations, including CFAP-2.”

Program Eligibility

The CRS report stated that, “Under CFAP-2, eligible commodities are broadly identified as those commodities that faced continuing market disruptions, low farm-level prices, and significant market costs due to the COVID-19 pandemic. USDA stated that significant marketing costs could be associated with declines in demand, surplus production, or disruptions to shipping patterns and the orderly marketing of commodities. Under this guidance, and to facilitate the development of inclusive payment formulas, USDA established three commodity payment categories—price-trigger commodities, flat-rate commodities, and sales commodities—each with its own eligibility criteria and payment formula.”

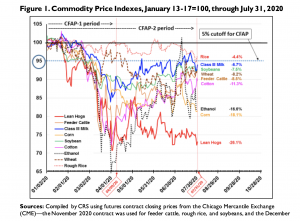

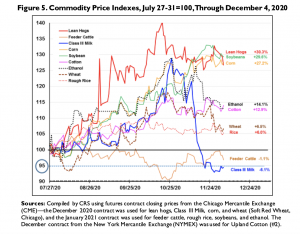

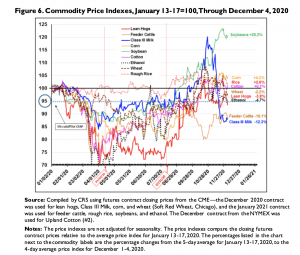

“For commodities for which price data were available, USDA assessed whether at least a 5% or greater price decline had occurred between January 13-17, 2020, and July 27-31, 2020,” the report said; adding that, “These qualifying commodities were identified as ‘price trigger commodities’ and include barley, corn, sorghum, soybeans, sunflowers, upland cotton, wheat (all classes), broilers, eggs, beef cattle, dairy, hogs and pigs, and lambs and sheep.”

“The mid-January to late-July period used to evaluate CFAP- 2 price declines represents a longer price-evaluation period than was used under CFAP-1 and reflects an attempt to quantify the second quarter effects of prolonged lower prices,” the report said.

Program Outlays

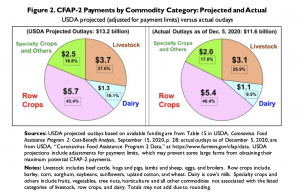

As of December 5, 2020, USDA had approved 759,089 applications and made $11.614 billion in outlays under CFAP-2, with cattle and corn producers receiving the largest amounts.

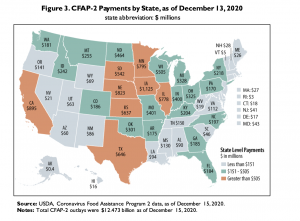

“The current CFAP-2 payment geographic distribution pattern is similar to CFAP-1’s—that is, payments are concentrated in the Corn Belt, Texas, and California.”

“USDA projects that once adjustments have been made to account for payment limits, a total of $13.2 billion in CFAP-2 funding will be allocated across the four different commodity groupings as follows: row crops ($5.7 billion, 43%); livestock ($3.7 billion or 28%); specialty crops and other ($2.5 billion, 19%); and dairy ($1.3 billion, 10%).”

The report noted that, “Prior to adjusting for payment limits, USDA projects that corn producers would be eligible to receive the largest outlay—$3.5 billion—from among the many eligible commodities , followed by cattle ($2.8 billion), dairy ($2.0 billion), hogs and pigs ($1.7 billion), and soybeans ($1.4 billion) [See figure 2 above].”

Future Government Assistance

Mr. Schnepf indicated that,

Because CFAP payments are intended to offset both sales losses due to price declines and higher marketing costs due to supply chain disruptions, a return to normalcy for these two criteria (market prices and supply chain activity) would likely signal an end to the need for federal assistance.

Mr. Schnepf added that, “Since late July, most of the major crop and livestock commodities (dairy and beef cattle being notable exceptions) have seen their prices increase substantially under improving market conditions, which include tighter supplies and increasing international demand.”

The report stated that, “When market price data are appended to the pre-COVID-19 price index chart, all major row crops and hogs have moved out of the 5%-price-decline qualifying zone; beef cattle and dairy continue to experience low market prices relative to the pre-COVID-19 period.

“As a result, if current market conditions were to persist into the first half of 2021, it would appear that price declines would be a possible reason for a new round of CFAP payments for livestock and dairy, but not for row crops.”