As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Wall Street Journal: “Revival” in the Farm Belt, But Things Can Turn Quickly

Wall Street Journal writers Jesse Newman and Bob Tita reported in Monday’s paper that, “A revival in the U.S. Farm Belt is in full swing, boosting markets for land and equipment and raising concerns over farmers’ escalating costs.

Most individual expense items forecast to increase in 2021.

— Farm Policy (@FarmPolicy) September 3, 2021

-- Farm Income and Financial Forecasts for 2021, September 2021, @USDA_ERS webinar. pic.twitter.com/9nouwsIkEI

“A monthslong rally in prices for major agricultural commodities such as corn and soybeans is pushing up incomes for U.S. farmers and unleashing spending and investment that had been subdued for years, according to agricultural economists and executives. The run-up in land and equipment prices that has followed could leave farmers exposed if big harvests send crop prices lower again, some economists said.

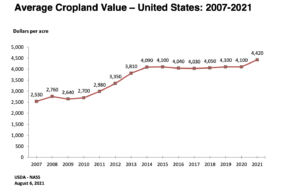

“U.S. cropland values hit a record this year, federal data shows. Prices for new and used farm equipment have soared, as rising sales and disruptions in key components, such as semiconductor chips, cause shortages and delivery delays for new machinery.”

The Journal article noted that, “Retail sales volumes of new high-horsepower tractors in the U.S. were up 27% from year-ago levels during the first eight months of 2021, according to the Association of Equipment Manufacturers. The red-hot machinery market has produced a windfall for manufacturers like Deere, whose profit from large farm equipment surged 50% in the company’s latest quarter.

‘It’s like the Wild West out there right now,’ said Scott Irwin, an agricultural economist at the University of Illinois, referring to the scramble for land and equipment.

Newman and Tita pointed out that, “Until recently, U.S. farmers were in the grips of an agricultural recession brought on by a world-wide crop glut. Starting last year, however, strong demand from China and poor weather in key growing regions fueled a sharp rise in prices for crops like corn and soybeans, which touched their highest levels in eight years during the spring. U.S. agricultural exports are expected to hit records in fiscal 2021 and 2022, according to U.S. Department of Agriculture forecasts.

“That helped spur a sharp reversal in farmers’ fortunes, with the USDA projecting this month that net farm income would surge 20% in 2021 to $113 billion, the highest since 2013.”

Monday’s article explained that, “Inflation is also hitting the Farm Belt, boosting almost all farmers’ production expenses this year, including fertilizer and fuel. The USDA expects production expenses to rise by more than 7% in 2021, the agency said. Farmers’ bills for supplies such as seed and fertilizer bought for next year will be the highest ever, [Michael Swanson, agricultural economist at Wells Fargo & Co., a major farm lender] said.

Luke Worrell provided an overview of some of the key farmland value findings from a recent survey of the #Illinois Society of Professional Farm Managers and Rural Appraisers during Thursday's farmdoc webinar (90 second clip).

— Farm Policy (@FarmPolicy) September 3, 2021

* #Illinois farmland values: ⬆️20%. pic.twitter.com/rMTFNhZeUu

“For now, the better prospects have farmers and investors competing fiercely for land. The value of U.S. cropland averaged a record $4,420 an acre this year, according to USDA data, an 8% increase from 2020. Farm real-estate values, a measure of the value of all land and buildings on farms, also hit an all-time high.”

farmdoc's Gary Schnitkey provided some historic context on the capitalization of farmland values during Thursday's webinar (one-minute clip). pic.twitter.com/HN76rTRDxR

— Farm Policy (@FarmPolicy) September 3, 2021

The Journal article added that, “Farmers are also paying more to rent land, according to August reports from two regional Federal Reserve Banks. Cash rent on cropland was up 7% as of the second quarter versus year-ago levels, the largest increase since 2013, according to the Kansas City Fed region, which includes states such as Kansas and Nebraska. In the Minneapolis Fed region, cash rent for some land rose more than 9%.”

“Corn is currently trading around $5.25 a bushel. Mr. Irwin, of the University of Illinois, said he wouldn’t be surprised to see prices drop below $4 next year. The current period is similar to the mid-1970s, Mr. Irwin said, when surging grain prices and low interest rates drove farmland values higher before the 1980s farm crisis.

“‘Right now the sector financially is in very good shape but things can turn quickly,’ he said.”