A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

COVID-19 Roils Ag Markets- Income, Food Prices, Production Impacted as Legislators Weigh In

Washington Post writers David J. Lynch, Annie Gowen and Laura Reiley reported this week that, “President Trump promised this year to deliver a financial bonanza for American farmers, boosted by two historic trade deals that would free them from their dependence on government bailouts.

“From farm gate to grocery aisle, the incredible tumult of the past two months is the fault of a microbe the president has dubbed the ‘invisible enemy’ — and what critics say has been his erratic response to its attack. The health crisis also has exposed an agricultural economy that despite repeated injections of taxpayer support finds many farmers under growing and unexpected financial pressure.”

The Post article noted that, “Instead of the record earnings [Pres. Trump] predicted in Austin [at the American Farm Bureau annual meeting], farmers this year face losses of more than $20 billion, according to the University of Missouri’s Food and Agricultural Research Institute.

“Expectations of massive Chinese orders for American crops under the trade deal Trump signed shortly before traveling to Austin are clouded by an escalating war of words between Washington and Beijing over the novel coronavirus. With pandemic-related restaurant closures disrupting commercial links, farmers are being forced to plow under their crops and destroy their livestock rather than bring them to market.”

Some analysts say only extraordinary federal aid will enable farmers to continue making their loan payments as the economy struggles to recover from the covid-19 pandemic. Prices for commodities such as corn and wheat have dropped since March by double-digit percentages

Lynch, Gowen, and Reiley stated that, “The highest hopes rested on China’s commitment to roughly double over the next two years purchases of U.S. farm goods, including beef, pork, poultry, seafood, soybeans, rice and animal feed. But Trump also touted a provision in the new North American trade agreement that required Canada to open its dairy market, which was expected to produce a modest $300 million gain for American farmers.”

The Post article indicated that, “The latest round of [federal government] aid is designed to fill a financial hole that will top $20 billion this year, according to the University of Missouri’s Food and Agricultural Research Institute. Economist Seth Meyer, the institute’s associate director, said that figure likely understates farmers’ losses since it assumes a rapid V-shaped economic recovery, which looks unlikely.”

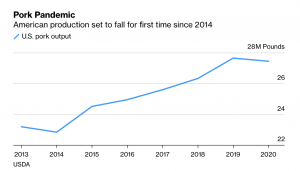

Meanwhile, Bloomberg writers Michael Hirtzer and Lydia Mulvany reported yesterday that, “Meat-processing disruptions in America are set to cost billions of pounds in lost production, snapping a yearslong run of growth in the industry, according to the U.S. Department of Agriculture.

“In its monthly outlook report, the USDA slashed its annual forecasts for pork, beef and chicken as virus outbreaks among workers force plants to shut or slow. Annual pork and beef output will be lower for the first time since 2014 and 2015, respectively, the agency predicted.”

And Samantha Masunaga, Sarah Parvini, Susanne Rust reported in today’s Los Angles Times that, “There’s no shortage of demand for beef.

“Prices are up. Grocery stores are limiting how much each customer can buy. Last week more than 1,000 Wendy’s restaurants ran out of hamburgers.

“There’s also no shortage of cattle earmarked to be turned into beef.

“But prices for those animals have dropped. Sales are down. At a recent livestock auction in the San Joaquin Valley, just a handful of buyers bothered to make an appearance.

“The problem is in the middle of this pipeline: the crisis at meat processing plants.”

Today’s article noted that, “The feedlots have been particularly slammed by the bottleneck. With slowdowns at the processing plants, feed yard operators are forced to keep the cattle longer. That means more feed and maintenance expenses.

“A few months ago, cattle prices were $1.19 per pound for livestock slated for May and June delivery to meat processing plants. The price has since dropped to 92 cents per pound, said Jesse Larios, who operates two feed yards in Imperial County.”

More broadly, Laura Reiley reported yesterday at The Washington Post Online that, “Grocery prices showed their biggest monthly increase in nearly 50 years last month, led by rising prices for meat and eggs, the U.S. Bureau of Labor Statistics reported Tuesday.

“U.S. consumers paid 4.3 percent more in April for meats, poultry, fish and eggs, 1.5 percent more for fruits and vegetables, and 2.9 percent more for cereals and bakery products, the Labor Department said.”

Grocery costs jumped most in 46 years as millions lost their jobs last month

— Saleha Mohsin (@SalehaMohsin) May 12, 2020

The White House, GOP are in a wait-and-see mode before working on another stimulus packagehttps://t.co/kZv9Kj8c2q pic.twitter.com/UBOF6r7InZ

“Overall, consumers paid 2.6 percent more in April for groceries, the largest one-month jump since February 1974,” the Post article said.

Today's CPI release showed a 7.5% increase in retail beef prices in April compared with last year, even before the extreme increase in wholesale prices more recently. Increases in other meat product retail prices also the largest in about 5 years amid supply chain disruptions. pic.twitter.com/ysf6H7AdT3

— Nathan Kauffman (@N_Kauffman) May 12, 2020

Year over year changes in CPI, selected ag products pic.twitter.com/Q0YIPllpl5

— JoeGlauber--IFPRI (@JoeGlauber1) May 12, 2020

“The legislation was spearheaded by Sens. Chuck Grassley, R-Iowa, and Jon Tester, D-Mont., along with three other senators.

“Grassley said Tuesday that Iowa residents are increasingly noting the discrepancy between high beef prices and low cattle prices.”

Joined my friend @chuckgrassley to introduce a bill that will provide necessary transparency in the cattle industry so producers get paid a more fair price for their product. https://t.co/rzvPrmWlHW https://t.co/dMQjsvkQoP

— Senator Mike Rounds (@SenatorRounds) May 12, 2020

Mr. Clayton also explained that, “While Grassley and others advocate for greater cash trade in the market, another set of senators on Tuesday added their letter to the multiple requests already sent to the Department of Justice.

“Sen. Deb Fischer, R-Neb., spearheaded Tuesday’s letter with a bipartisan group of 19 senators asking DOJ to ‘investigate potential anti-competitive activities in the highly concentrated beef packing sector.’ Several other senators had written similar letters to the Department of Justice last month as well. Then, the president also declared his support for such an investigation.”

Today I led a bipartisan call requesting Attorney General Barr & @TheJusticeDept investigate potential illegal practices by meatpackers.

— Senator Deb Fischer (@SenatorFischer) May 12, 2020

This letter, signed by 18 of my colleagues, raises concerns about pricing discrepancies between cattle producers & processing plants. pic.twitter.com/GM4IslaZ6k

The DTN article indicated that, “Members of Congress have been pitching several plans to help both cattle and pork producers with their market situation, given the way COVID-19 has disrupted the packing industry and livestock markets.”

Iowa’s pork producers are suffering from restaurant and meat processing plant closures. The crisis is immediate. I sent a bipartisan letter urging additional support for producers who are being forced to depopulate livestock herds. pic.twitter.com/cPchfHZ9LN

— Joni Ernst (@SenJoniErnst) May 11, 2020

Today I joined @ChuckGrassley and 12 of our bipartisan colleagues in a letter to Congressional leaders, urging indemnity support for pork producers who are being forced to depopulate livestock herds because of processing plant closures due to COVID-19. https://t.co/JvUQB4rukA

— Senator Mike Rounds (@SenatorRounds) May 11, 2020

Also yesterday, Reuters writer Stephanie Kelly reported that, “U.S. lawmakers on Tuesday introduced a relief bill that would include aid to biofuel producers after demand for the fuel plummeted because of the coronavirus pandemic, causing mass shutdowns in the industry.

“The bill, introduced by House Democrats, would reimburse producers that suffered unexpected market losses because of the pandemic from January 1 through May 1. It is not clear whether the bill as proposed will be passed into law.”

A letter led by Rep. Cheri Bustos was sent to House leadership requesting support for the biofuel sector in the next #COVID19 legislative relief package. The letter details the genuine need for relief and why producers and those in related industries need relief now. pic.twitter.com/iFHGd6Kz4J

— Renewable Fuels Association (@EthanolRFA) May 12, 2020

“Eligible producers would receive 45 cents a gallon for fuel produced during the January-May period, according to the bill. If a facility was unable to make fuel during one or more months during the period, the producer would receive 45 cents multiplied by 50% of the number of gallons produced from year-ago levels,” the Reuters article said.